To be listed on the CAMPOSOL TODAY MAP please call +34 968 018 268.

article_detail

Date Published: 10/10/2025

Instant bank transfers in Europe get new safety checks from October 9

Banks in Spain and the rest of the EU must now verify that the recipient’s name matches the IBAN before approving instant payments

From Thursday October 9, stronger rules for instant bank transfers came into force across the euro area. These changes aim to make instant payments safer, more reliable and fairer for everyone.

Banks and payment service providers must now do more to protect customers when sending money instantly. One of the key new rules is that before an instant transfer is carried out, the bank must check whether the name of the person or business receiving the money matches the IBAN (bank account number). If there is a mismatch, the bank must warn the sender.

This verification is meant to reduce mistakes, like typing the wrong account number, and help prevent fraud. The sender then gets to decide whether to go ahead with the payment.

These checks must be offered free of charge to the payer, so you will not pay extra just because your bank checks the name against the IBAN.

Another important rule is that instant transfers cannot cost more than ordinary (non-instant) transfers of the same type. In practice, that means if your bank offers standard transfers for free, or at a low cost, they cannot charge more just for making them “instant.”

However, these changes don’t exactly mean that all payments must be instant. What is mandatory is that banks that already support regular euro transfers must also support instant transfers by the deadlines, and that the new safety and pricing rules apply.

To this end, the deadlines have been staggered. From January 9, 2025, banks had to be ready to receive instant payments. From October 9, 2025, they must also start sending instant payments under the new rules (including the name/IBAN check).

In Spain, these changes reinforce what was already starting to happen. Banks are being required to offer instant transfers under fair pricing and the name/IBAN check adds an extra layer of protection.

For users, this means safer transactions. If you type in an account number incorrectly and the name doesn’t match, the bank will alert you before the transfer goes through. It also means you may see instant transfers becoming the normal or default option, rather than the more delayed option. And you should not be charged more just because you want your money to move instantly.

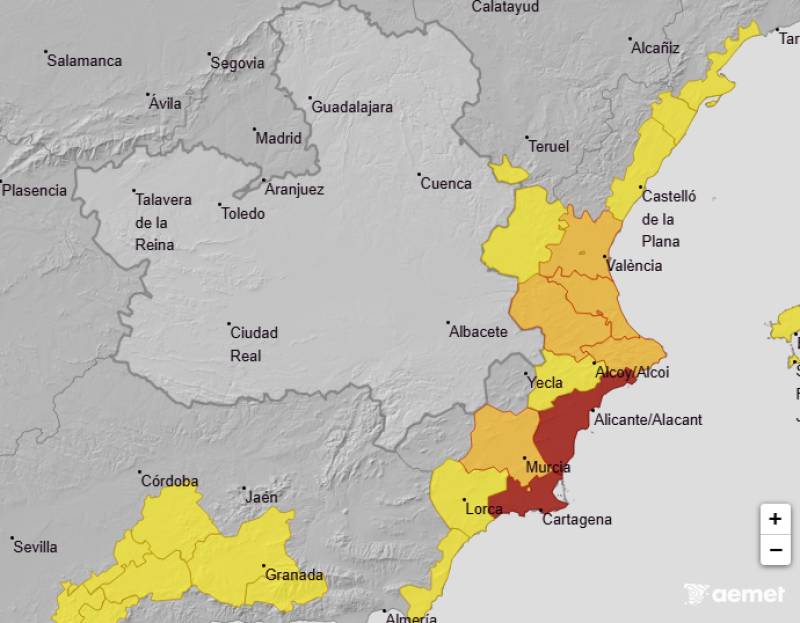

In other news: Videos & pics: Dana Alice batters Murcia and Alicante

Image: Archive

Address

El Albujon, Cartagena, Murcia, 30330Tel: 0034 644 462 145

Loading

Free energy bill comparison anywhere in Spain

Spanish Energy, in collaboration with Gana Energy, offers a comprehensive comparison of energy plans and products in English.

Their knowledgeable team will guide you through the different options for saving money on your energy bills in Spain, explaining how their plans work and answering any questions you may have.

There is no fee for switchover, no hidden charges and the energy comparison is completely free.

To reach out to them for a FREE quote, send a WhatsApp to +34 644 462 145 or email steve@spanishenergy.es.

Alternatively, you can go to www.spanishenergy.es and all you have to do is submit a recent energy bill to get your FREE, no-obligation switchover quote and start saving straight away!

Contact Murcia Today: Editorial 000 000 000 /

Office 000 000 000